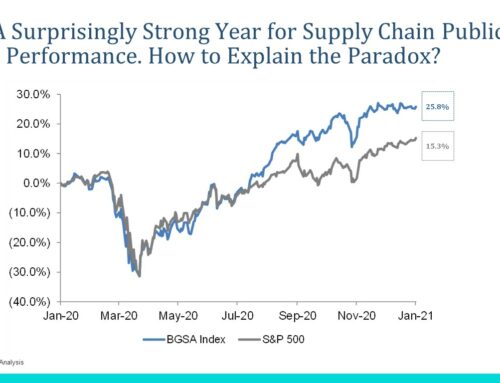

In the world of e-commerce fulfillment, we have experienced a golden age for logistics providers. For two decades, the market has grown at a rate of better than 20 percent, fueled by the explosion of e-commerce providers like Amazon. Warehousing and logistics companies attracted investment and acquisition interest. A rising tide lifted all boats, and thousands of e-commerce fulfillment companies benefited from the broad range of successful e-tailers.

However, 2019 was a turning point. This golden age of growth and investment is about to change. On the one hand, new disruptors like ShipBob are using technology to provide lower-cost e-commerce fulfillment solutions. On the other hand, large consolidators like Radial Commerce are deploying investment capital to acquire competitors and pursue global scale.

When e-commerce back-end solution provider ShipBob raised $63m (including $40m in September 2018), it marked a new challenge. And when Belgian national post powerhouse bpost acquired the 24-fulfillment center Radial for $820m in late 2017, it reflected a massive investment of global capital into the sector.

Meanwhile, customers continue to expect faster response times. First, Amazon disrupted the status quo with Amazon Prime’s two-day shipping. Target countered with acquisitions of Grand Junction and Shipt, seeking to beat Amazon’s offering. Then Amazon upped the ante with Amazon Prime Now, boasting two-hour delivery. Customer demands will only accelerate going forward.

As a result, mid-sized e-commerce fulfillment companies are going to face a squeeze play. Winners will need to adapt by either (a) innovating in ways that make them easier to use, or (b) slashing cost and boosting locations to provide high-scale solutions. E-commerce fulfillment companies that fail to adapt will find themselves facing extinction.

What should your company do to be one of the winners? Let’s look at the market, the trends, and the decisions facing players in the e-commerce fulfillment space.

Market Evolution

E-commerce fulfillment companies are third-party vendors that fulfill orders for companies such as traditional e-commerce companies, online sellers via marketplaces, or even brick-and-mortar stores that do not possess warehouse and distribution facilities. Partnering with e-commerce fulfillment companies enables vendors to reduce infrastructure and logistics costs as well as improve operational efficiency and focus.

Strong e-commerce fulfillment companies provide several advantages, such as:

- Lower costs of shipping. The strong infrastructure of e-commerce fulfillment companies enables bulk discounting, and strategic locations of warehousing and shipping facilities enable lower cost of transportation, and thus, shipping.

- Elastic scaling for peak demand periods. The seasonality inherent in most e-commerce businesses does not support a steady-state employee count throughout the year being enough to always meet demand; e-commerce fulfillment companies allow for a variable workforce and fulfillment capabilities that perfectly match demand, no matter how much it fluctuates.

- Significant geographic reach. Most e-commerce fulfillment companies have a broad reach, and a large number of them can fulfill both domestically and internationally, providing significant scale benefits to an e-commerce company that it could not otherwise enjoy.

- Dedicated customer service. Specialized e-commerce fulfillment companies, especially those who leverage technology for automation and scalability, can be a great partner for e-commerce companies to provide superior customer service and order support despite a company’s small overall size and scale.

- Ability to focus on core competency. E-commerce vendors should be able to meet customer needs and focus on what they are most successful at — attracting and converting customers. A strong e-commerce fulfillment partner can allow an e-commerce business to specialize and focus in today’s hyper-competitive world.

E-Commerce Fulfillment

E-commerce fulfillment has grown explosively on the back of broader e-commerce growth, and there has been a broad range of winners in fulfillment over the past 15 years. Consumers spent $409bn in online retail purchases in 2017, a 13.5 percent increase compared with $360bn in 2016. Additionally, e-commerce accounted for 49 percent of the total retail sales growth. Continued rapid growth is expected through 2022 at beyond, as e-commerce takes an increasing share of the retail market in the United States, and grows even faster internationally.

E-commerce fulfillment companies have gained significant momentum over the years, especially with so many start-up e-commerce vendors and fast-growing small and medium-sized businesses today that do not have infrastructure or logistics facilities in-house. Pure-play fulfillment services companies such as Radial and Red Stag Fulfillment, as well as tech-enabled players like ShipBob and ShipMonk have succeeded while competing with industry behemoths like Amazon and FedEx. Each of those companies either directly provides or enables e-commerce fulfillment, but there are some important nuances to each company’s model.

Competitive Dynamics

There are three broad categories of companies providing e-commerce fulfillment services: divisions of large e-commerce or logistics powerhouses, pure-play e-commerce fulfillment services companies and tech-focused start-ups.

Fulfillment by Amazon (FBA) is one of the largest e-commerce fulfillment players globally. FBA allows anyone to sell their items on the Amazon platform and allows businesses to tap into Amazon’s renowned logistical capabilities and a global network of warehouses to take care of the bulk of the fulfillment work. Similarly, FedEx Fulfillment, a subsidiary of FedEx Corp., was launched in 2017 to help small and medium-sized businesses fulfill orders from multiple sales channels, including marketplaces (like eBay) and a company’s own website. FedEx Fulfillment leverages the transportation network of FedEx Corp. and provides a full suite of logistics services, such as warehousing, packaging, fulfillment, transportation and reverse logistics.

Radial (formerly eBay Enterprise) is one of the largest pure-play e-commerce fulfillment services companies. Radial fulfills well over 300 million orders per year for retail customers across 24 fulfillment centers, generated over $1bn in revenue in 2016 and was acquired in 2017 by Belgian postal operator bpost for $820m. Red Stag Fulfillment is another large pure-play that specializes in shipments over five pounds and combines a proprietary cloud-based fulfillment platform with significant operations expertise to offer high-touch service to customers.

There have also been start-up challengers that have attracted significant funding in an attempt to disrupt the incumbents. ShipBob is one of the higher-profile start-up challengers, primarily due to the fact that it has raised over $60m of venture capital in just over four years of existence. ShipBob aims to provide “Amazon-level logistics to small and medium-sized businesses” and charges a flat-raise of $35 per delivery, which is a unique and easy-to-market pricing model. Additionally, Shipmonk, which just raised $10m in early November 2018, is another start-up that combines e-commerce fulfillment and inventory management software in a flexible tech-forward platform that is easy to install and scale with customers of all sizes.

In a market with significant M&A activity and record fundraising, there will be an arms race to either achieve global success or fall behind and fail.

Consumer Is King

The introduction of Amazon Prime in 2005 started the trend of consumers demanding faster service and lower cost. Amazon changed the rules of e-tail with Prime’s two-day shipping and raised the bar of performance expectations for all market participants.

Amazon has raised expectations for consumers. Other retail companies are making bold moves to compete.

Target, trying to catch up with Amazon in e-commerce logistics/fulfillment, acquired Grand Junction and Shipt in 2017 for over $500m.

Grand Junction is a technology transportation company whose software manages local delivery throughout North America, allowing retailers, distributors, and third-party logistics providers to offer local delivery through Grand Junction’s technology and network of more than 700 carriers.

Shipt is a rapidly growing membership-based grocery marketplace and same-day delivery platform. The service leverages an extensive network of over 20,000 personal shoppers to fulfill orders from various retailers and deliver within hours in more than 72 markets.

The arms race is continuing. Amazon, continuing to innovate and push the envelope, introduced Amazon Prime Now, which boasts same-day two-hour delivery windows. Meanwhile, a 2018 Zebra Technologies study revealed that 78 percent of logistics companies expect to provide same-day delivery by 2023 and that 40 percent anticipate delivery within a two-hour window by 2028. As a result, retailers, logistics companies, and start-ups have been investing capital in systems and infrastructure that will allow them to meet, and ideally exceed, the ever-higher standards that are now expected by the consumer.

Deals, Deals, Deals

The sheer amount of investment and acquisition capital in the e-commerce fulfillment arena reflects the market’s attractiveness, but also will produce defined winners and losers in a very short time period.

After bpost’s acquisition of Radial and Target’s acquisitions of Grand Junction and Shipt, other incumbents with strong cash positions will look to boost their e-commerce fulfillment capabilities through transformational M&A. Strong mid-sized players with established market positions will be well-positioned to get acquired for sizeable multiples and achieve great outcomes for all stakeholders.

Additionally, the influx of venture capital investment into companies like ShipBob and Shipwire will continue into more start-ups. Venture capitalists tend to move in packs, and emerging e-commerce fulfillment companies that innovate on features, simplicity, automation, interoperability or price will likely attract significant investment, with associated expectations on investment outcomes and time frames for achieving investment returns, leading to a race to scale. There can only be a handful of winners in a venture-funded atmosphere of high cash burn and “growth at all costs”, and several companies will likely go bust over time.

Implications for Mid-Sized E-Commerce Fulfillment Companies

How can you ensure that your company will be one of the success stories in e-commerce fulfillment?

- Know who you are. Services-focused companies vs. tech-focused companies vs. hybrids all have different advantages, disadvantages, and ways to win, but having a corporate identity as one of the three will help a company focus on achieving relevant results and not trying to do too much.

- Focus on customer experience, but do not forget about your customer’s customer experience. e-commerce fulfillment is really a B2B2C market, and being able to have happy customers (e-commerce companies) as well as happy end consumers (purchasers of goods) is the easiest way to produce long-term successful relationships that increase the customer lifetime value economics to your business, which directly influences a business’s enterprise value.

- Leverage technology, and do not be afraid to partner with related businesses. Given all of the advancements in logistics-related technology for automation, a company should not try to do everything themselves; API-driven technology partnerships can be beneficial to all companies in the sector, and also allow businesses to focus on core strengths that can scale, yet offer many features.

- Either be better or be bigger. Given a large number of market participants in e-commerce fulfillment, winners will either need to have the scale and cost-effective pricing to move significant volume efficiently around the globe or have innovative and better features that make the e-commerce fulfillment experience significantly easier for e-commerce companies.

As e-commerce continues to grow and e-commerce fulfillment continues to become more competitive and disrupted by new entrants and increasing demands from customers, companies should embrace the trends and adjust to the implications of what it means to be a successful e-commerce fulfillment business in this new “e-conomy.”

At Cambridge Capital in West Palm Beach, Benjamin Gordon is managing partner and CEO.

See variations of this article at Medium and SupplyChainBrain, and videos at Vimeo and YouTube.