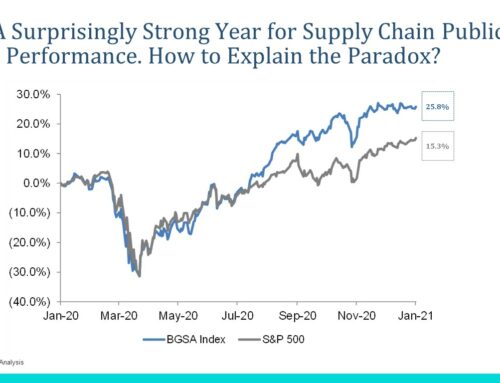

Benjamin Gordon is CEO of Palm Beach’s Cambridge Capital, a private equity firm investing in transportation, logistics, and supply chain technology. Benjamin is also CEO of BG Strategic Advisors (BGSA), a leading investment banking firm in the supply chain sector. With decades of experience in advising supply chain CEO in mergers, acquisitions, merchant banking and other strategic initiatives, he is a recognized expert and advisor in the supply chain industry.

The following is a Q&A with Palm’s Beach Ben Gordon to get his expertise on litigation in the merger and acquisition space.

Q: What are the most common types of lawsuits that companies (and/or individuals) encounter in the M&A space?

M&A is a field of high stakes. When an entrepreneur chooses to sell his or her business or take on an investment, it is often the one of the most important decisions that entrepreneur can make. The good news is that the deal can create a windfall of wealth for the owner. One risk, however, is that high stakes can sometimes lead to disputes.

The most common types of deal disputes tend to revolve around uncertainty. When a buyer and seller agree to a deal, no matter how long the purchase agreement is, there are often points of ambiguity.

Earn-outs

One example is earn-outs. Is the earn-out based on achieving a net income or EBITDA target? How are those earnings calculated? If the buyer adds overhead, does that reduce the earnings the seller generates, and hence the earn-out? What about if the buyer adds customers? Or conversely, if the buyer chooses to make changes in the business? All of these are areas where disagreements can result if not handled carefully in advance.

Representations & Warranties

Another example has to do with representations and warranties. A buyer or investor typically gives a seller assurances with respect to the business. What happens when there are surprises? If a customer decides to withhold payment, or to sue, for an action that was taken prior to the deal, is that a new development or a prior, undisclosed liability?

Non-Competes

A third example relates to non-competes. Often when a buyer invests in a business, the expectation is that the seller will remain with the business for a period of time, and will not start or join a competing company. But what happens if that seller agrees to advise a company? Or join a board? Or make a minority investment?

Escrows

And a fourth example revolves around escrows. When a buyer acquires a company, a portion of the proceeds may sit in escrow. Does the money get released? Is there a disagreement around terms/conditions?

Q: How often do mergers and acquisitions trigger shareholder lawsuits?

A 2010 Litigation in M&As study conducted by Randall Tomas, a Professor of Law at Vanderbilt University, found that 12% of M&A offers lead to litigation, with shareholder lawsuits accounting for the majority. These investor class action filings have risen almost 40% since then. Firms that announce a merger or acquisition are commonly accompanied by shareholders of the acquired company either asking for additional in-depth information or making a claim that the price is not high enough. Due to the pressure to close, these M&A cases are settled relatively quickly, meaning companies will provide more information or change terms of the deal entirely.

Unfortunately, there is fairly little that companies can do to avoid these impending lawsuits. In addition, when plaintiffs bring these lawsuits against public companies, it often attracts the attention of the SEC. In turn, the SEC can open their own expensive and time-consuming investigation. Most companies and individuals lack the resources to contest an SEC lawsuit, which can cost tens of millions of dollars. So the ripple effects can be enormous.

However, there are certain precautions to take to reduce the likelihood of investors pursuing litigation.

Q: What are some of the largest M&A settlements of lawsuits in the past decade?

Out of the list of largest M&A settlements of lawsuits over the years, one of the biggest was the Kinder managed buyout in August of 2010 for $200 million. Another large settlement occurred a few years later in July of 2012 when Kinder acquired El Paso for $100 million. Let’s not forget the Del Monte Foods buyout in October 2011 for $89.4 million.

Q: Were there any trends associated with the larger M&A settlements?

A lot of M&A settlements are typically somewhere under $20 million, but some can definitely range into the hundred millions. The reason why certain settlements are significantly higher than others is because the larger payout settlements involve conflict of interest allegations, typically involving financial advisors.

For example, in the Kinder buyout for $200 million, the buyout, the acquirer, the acquirer’s financial advisor, and the target’s advisor were all affiliated with Goldman Sachs. A similar situation also occurred when Kinder Morgan acquired El Paso a few years later for $100 million. El Paso’s advisor was Goldman Sachs’ investment banking arm. Meanwhile, Goldman Sachs’ private equity arm actually owned 19 percent of Kinder Morgan—not to mention, they also had two members on Kinder Morgan’s board.

Q: What can companies being acquired do to mitigate potential lawsuits?

Cambridge Capital relies on consultants in due diligence, and many times we have walked away from deals when we have seen a high risk of litigation. That said, for buyers, sellers and investors, you can’t predict the future. Here are three things you can do.

- Clearly define the business issues in advance. You can’t just rely on lawyers. No matter how good they are, lawyers take their cues from their clients. Do you expect any challenges with respect to earn-outs? Are you particularly concerned about being free to invest in other companies? As an owner, you need to address these issues upfront.

- Follow Occam’s razor, and keep it simple. If you have an earn-out, try to base it on unobjectionable criteria. Revenue is better than EBITDA. One year is better than two years. If the earn-out is based on earnings, then an agreement on cost accounting is a must.

- And above all, pick business partners based on trust. No amount of legal protection can substitute for doing business with ethical partners that you like and trust.

Q: What are the top M&A deals to watch so far this year?

As we all know, the most popular M&A deal this year in 2017 was Amazon’s acquisition of Whole Foods for almost $13.5 billion in their pursuit of frictionless ecommerce. Although this M&A deal was certainly shocking to many, it actually only ranks as only the 7th largest deal in 2017 thus far.

The biggest M&A deal in 2017 occurred in April when Beckton, Dickinson & Co’s, a medical supplies manufacturer, acquired C.R. Bard Inc. for $24 billion. The second largest deal was medical nutrition leader Mead Johnson’s merge with Reckitt Benckiser Group, a consumer goods company specializing in health, hygiene, and home products. This M&A deal wrung in at $17.7 billion.

All three of these are huge deals that are contenders to follow! Stay tuned.