Originally published at logisticsmgmt.com on June 29, 2015.

In the third-party logistics (3PL) sector, the ongoing trend of merger and acquisition (M&A) activity never seems to take a break.

That is apparent in recent weeks alone, with XPO Logistics recent acquisition of Norbert Dentressangle for $3.53 billion, Echo Global Logistics scooping up Command Transportation for $420 million, and Kuehne+Nagel buying ReTrans for an undisclosed sum.

While these are just three examples of recent and significant deals, there are several others as well, too. And according to Ben Gordon, managing director of BG Strategic Advisors, the current pace is not expected to subside any time soon.

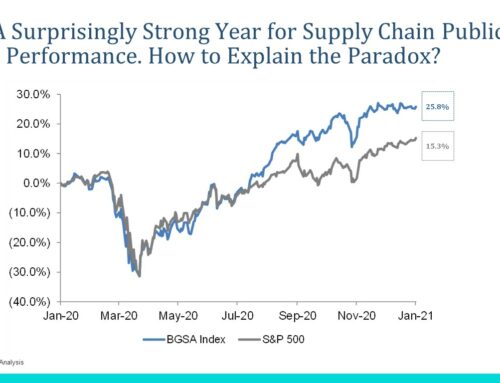

“If you look at the history of M&A in transportation and logistics, it has only gotten busier and busier,” said Gordon at the eyefortransport 3PL Summit in Chicago earlier this month. “We are at all time levels of activity right now, not only in our sector but for M&A as a whole. Two years ago there was $1 trillion in total U.S. M&A activity, which seems like a big number, but then last year, it rose 40 percent to $1.4 trillion.”

And looking at the long-term ratio of M&A-to-GDP Gordon explained that the ratio over the last 30 years is at around 6 percent, with the current amount of activity at what he described as a baseline level.

That baseline level, he said, means that is room for continued M&A activity, too, especially in transportation and logistics, where there has been a tremendous amount of M&A from strategic buyers, private equity investors, and new entrants to the market, too.

Some key areas that the myriad deals in transportation and logistics are involved in relate to cross-border trade, cross-over services, service convergence, industry consolidation, and globalization, among others.

A recurring theme among executives at the 3PL Summit was that acquisition activity helps to fill a specific need or service gap that may have been missing.

In the case of XPO Logistics acquiring Norbert, its chairman and CEO Brad Jacobs explained one of the main drivers for the deal was getting “the scale to be a global supply chain provider,” coupled with complementary geographies are, and similar service offerings.

And Echo buying command, its top executive Doug Waggoner said that Command’s presence in the truckload brokerage market and its dense business and coverage in the Northeast and Southeast were key.

In regards to strategies that companies take in regards to vetting potential deals and acquisitions. Transplace CEO Tom Sanderson said that while his company has looked at sectors it is not active in like warehousing and international freight forwarding for example, it is more inclined to make deals in areas it has extensive experience and expertise in like intermodal, LTL and truckload brokerage and managed transportation. Another factor he cited when making decisions on whether or not to acquire a company hinge of company-specific things like having assets or being asset-light as well as geography where a company operates, too.