Earlier this month, Cambridge Capital made a $56 million Series C investment in byrd. At a time when the venture capital market is drying up, why is Cambridge Capital actively investing to expand its logistics portfolio? And why did Cambridge pick byrd, a digital ecommerce fulfillment provider in Europe?

We thought it might help to share why we chose to invest in byrd and how we at Cambridge continue to apply a consistent framework when looking at investments in the supply chain sector.

It all starts with the Cambridge strategy, so let’s begin there.

The Cambridge Strategy

Cambridge Capital’s strategy is to build a concentrated portfolio of high-conviction investments in tech-enabled supply chain-focused businesses with staying power and outsized growth potential.

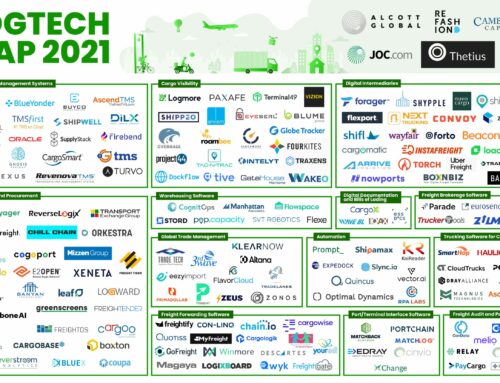

We begin with a set of themes that we believe drive success in the supply chain market. These themes include e-commerce fulfilment, last-mile delivery, cross-border flow of goods and supply chain visibility. Companies in these categories have tailwinds that provide an instant catalyst for growth.

We then seek entrepreneurs who are the best leaders, building strong companies with significant growth potential.

Our team conducts due diligence to validate our thesis. A new investment is the product of months of hard work from many sides: the founding and executive team, the Cambridge investment and operating teams, and various advisors and third parties that helped both sides finalize the investment.

For some firms, when a new investment is completed, it may feel like the finish line. At Cambridge, this is just the beginning of our journey with our new portfolio company partner. Once we close our investment, we then transition our focus to supporting our teams in achieving results for all stakeholders. Each situation is unique, so whether it’s assisting with key leadership hires, improving value-based selling practices, finding customers and partners, or helping with cross-portfolio collaboration, all of the Cambridge team is there to be of service.

Why We Chose byrd

So… how did we apply this thought process to our latest investment?

byrd, founded by Alex Leichter, Petra Dobrocka and Sebastian Mach, is the leading independent digital e-commerce fulfillment platform in Europe, enabling next-day e-commerce fulfillment via a network of approximately 25 warehouses in seven European countries. byrd uses its technology platform combining various OMS (Order Management Systems) with its proprietary WMS (Warehouse Management System) to connect more than 350 online retailers and D2C brands with fulfillment centers and shipping services across Europe.

The investment in byrd is an amalgamation of what we seek in every new portfolio company and a reminder as to why we continue to focus exclusively on where we can be the most impactful in supporting the amazing teams that we are fortunate enough to back.

In order to prioritize opportunities and ensure consistency of focus, we came up with a framework to hold ourselves accountable to benchmark new potential opportunities, with six pillars: Cambridge thematic fit, market tailwinds, capital efficiency, strong tech-enabled moat, top team, and the ability to create a Cambridge-influenced edge.

We believe companies that score high on all these attributes have the largest potential to become winners, and we make sure that we only focus on companies that have all six attributes.

How byrd Compared

byrd stacks up extremely well on all six of Cambridge’s key characteristics.

- Cambridge Thematic Fit — byrd fits four of Cambridge’s currently published investment themes: e-commerce fulfilment, last-mile delivery, cross-border flow of goods and supply chain visibility. byrd’s cloud-based logistics solution allows retailers to optimize operations and unlock their growth potential on a global scale. By bringing online merchants closer to their customers, byrd helps merchants reduce delivery costs and shipping times. As a result, it helps retailers to turn fulfillment and shipping into a competitive advantage for e-commerce companies in the region.

- Market Tailwinds — Cowen & Company estimates that the global e-commerce fulfillment market will reach $960 billion by 2025, which represents a 16% CAGR. As global parcel volumes and proliferation of e-commerce continue to rise, byrd is well-positioned to capitalize on this opportunity — particularly in a currently underserved market.

- Capital Efficiency — Although byrd has previously raised venture capital, the company is extremely capital efficient. Gross profit-adjusted payback for customers has averaged just six months, and both customer count and average revenue per customer doubled over the last twelve months. Additionally, quarterly cohort dollar retention averages between 125–355% over the life of the business, and with a current focus on smaller customers, that is quite impressive.

- Strong Tech-Enabled Moat — Many digital e-commerce fulfillment businesses in the US and Europe laud their technology, but we have found most were not as advanced as advertised once we took a closer look. byrd, on the other hand, has a full platform of applications already in the market, with both customers and partners praising it as the best technology they have used to-date to manage e-commerce orders and fulfillment (and in some cases asking byrd to sell them their technology separately for other parts of their business).

- Top Team — The byrd team is simply best-in-class. Alex, co-founder and CEO, was a competitive rower and e-commerce entrepreneur in Europe who saw a huge opportunity to improve e-commerce fulfillment in a highly fragmented region with tremendous growth potential. Petra, co-founder and CCO, has a strong e-commerce sales and operational background in various European markets, and Sebastian, co-founder and CTO, is a brilliant software engineer with a compelling and achievable vision to continue to deepen byrd’s technology offerings to customers, partners and other stakeholders in e-commerce fulfillment.

- Cambridge-Influenced Edge — Since byrd has achieved strong product-market fit, exciting growth and high retention with existing customers in a variety of geographies and industries, they are ready to continue to exponentially scale up their sales and marketing engine. byrd sells to SME+ e-commerce merchants, with customers and partners throughout all of Europe, and Cambridge has strong relationships with many additional potential customers and partners, especially those that attend our annual conference held every January.

For all these reasons, we are excited to invest in byrd, grateful for the opportunity to partner with a terrific company and founding team, and eager to help them accelerate into their next stage of growth. For any e-commerce merchants who are active in Europe, or who want to be more active in Europe, byrd is a great potential partner. Feel free to reach out to us at Cambridge Capital for an introduction.

–Benjamin Gordon and Matt Smalley, Cambridge Capital